Streaming drives another record mid-year for Latin music in the US, led by paid subscriptions and steady audience expansion.

Overview

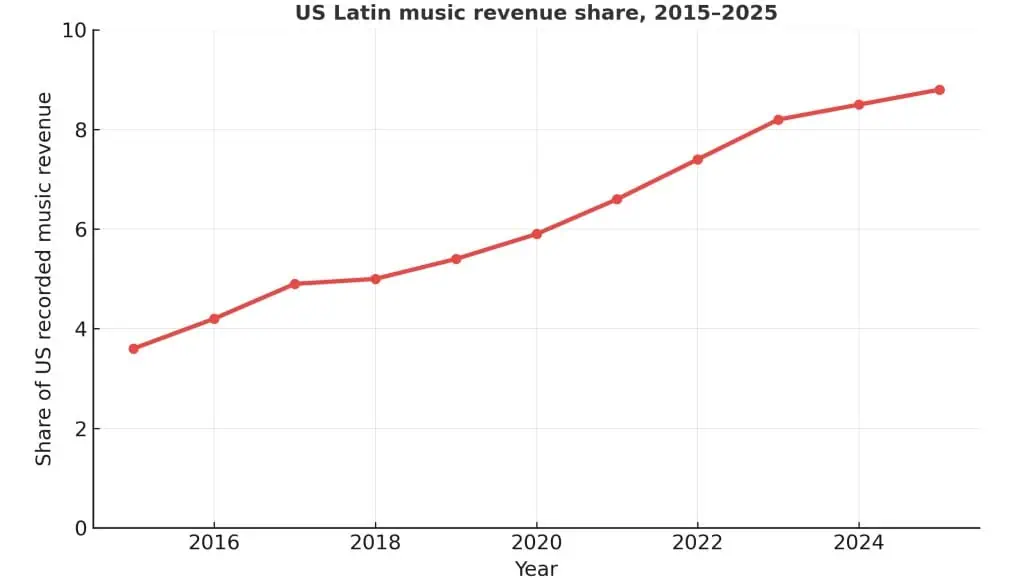

US Latin recorded music revenues reached $490.3 million in the first half of 2025, up 5.9% year-on-year according to the latest RIAA mid-year report. The genre now accounts for 8.8% of total US recorded music revenue, maintaining its double digit momentum from recent years. This compares with $463 million in H1 2024 and a record-breaking $1 Bn total for full-year 2024 although direct comparisons are difficult, as the RIAA now reports wholesale rather than retail sales.

Streaming remains the engine

Streaming generated $481.6 million of Latin music revenue in H1 2025 — nearly 98% of the category’s total and up 6.3% from the same period last year. Paid subscriptions alone climbed 11.2% to $271 million, showing that Latin listeners continue to migrate from ad-supported services to premium tiers. This mirrors the trend seen in H1 2024, where subscription growth offset slower ad-supported gains.

Market share and context

Latin music now represents 8.8% of all US recorded-music revenue, slightly higher than last year’s 8.5%, extending a 12-year streak of mid-year growth. While the pace has moderated since 2023’s double-digit jumps, the sector’s consistency contrasts with flatter results across other genres. Full-year 2024 data showed Latin’s first-ever $1 Bn year, setting the foundation for today’s steady expansion.

Broader Trends

- Catalogue depth continues to expand on streaming platforms.

- Cross-genre collaborations with mainstream pop and regional Mexican artists have widened audience reach.

- Physical sales remain negligible (< 2%), and downloads continue to decline.

Quick Takeaway

Latin music’s mid-year performance confirms its position as one of the US market’s most resilient segments. With nearly $500 million in six months and double-digit subscription growth, the genre’s momentum shows no sign of slowing — only evolving into long-term, sustainable strength.