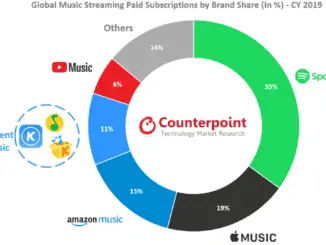

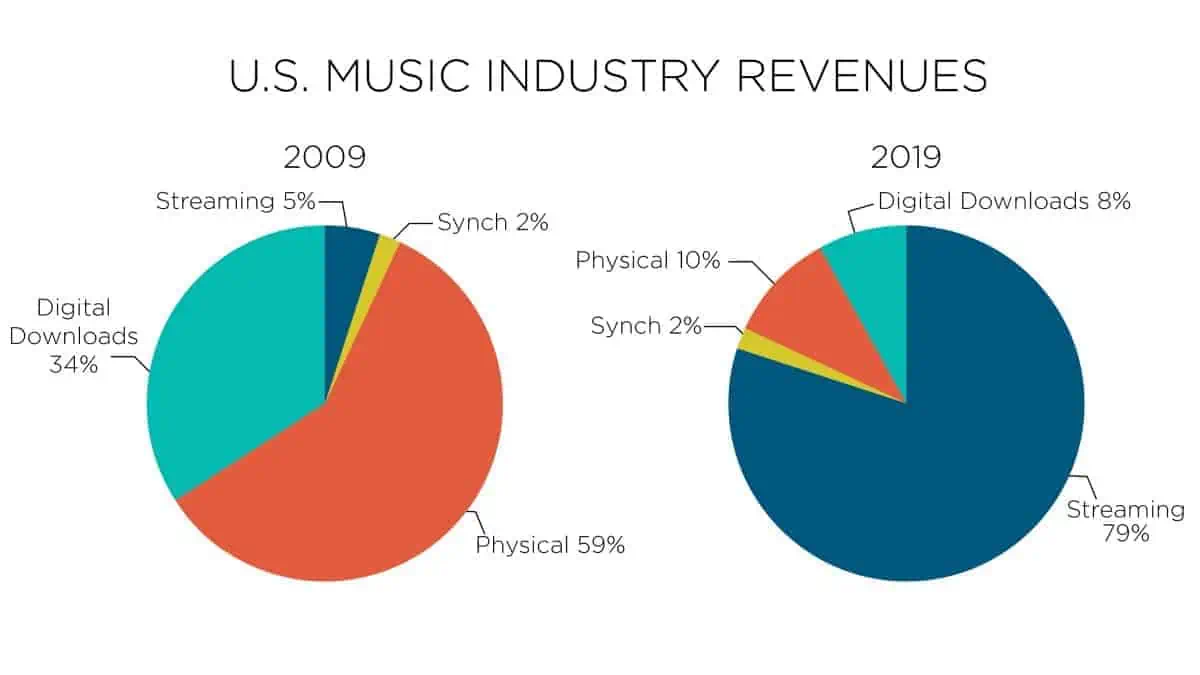

Streaming now accounts for 80% of music revenue in US growing 19.9% to $8.8 Bn in 2019 according to the RIAA’s 2019 year end report. Revenues from recorded music in the US grew 13% in 2019 from $9.8 billion to $11.1 billion representing the fourth year in a row of double digit growth. Growth was fuelled by paid subscription services which reached more than 60 million.

Paid subscriptions to on-demand streaming services contributed by far the largest share of revenues as well as the biggest portion of revenue growth for the year. Total 2019 subscription revenues of $6.8 billion were up 25% versus the prior year and accounted for 61% of total recorded music revenues in the US. The streaming market alone in 2019 was larger than the entire US recorded music market just 2 years ago in 2017. That total includes $829 million in revenues from ‘Limited Tier’ paid subscriptions (services limited by factors such as mobile access, catalogue availability, on-demand limitations, or device restrictions) such as Amazon Prime and Pandora Plus.

The number of fully paid subscriptions in 2019 grew 29% to an average of 60.4 million, compared with 46.91 million for 2018.

Revenues from on-demand streaming services supported by advertising (such as YouTube, Vevo, and the free version of Spotify) grew 20% annually to $908 million. These types of services streamed more than 500 Bn songs to more than 100 million listeners in the US, yet contributed only 8% to total music revenues for the year.

Revenues from digital and customized radio services decreased 4% year-over-year to $1.16 Bn in 2019.

Total revenues from digitally downloaded music were down 18% to $856 million in 2019, marking the first time since 2006 that revenues from downloaded tracks and albums fell below $1 Bn. Permanent downloads of albums fell 21% by value to $395 million, and individual track sales were down 15% to $415 million in 2019. Downloads accounted for only 8% of revenues in 2019.

Revenues from physical products in 2019 were down slightly year-over-year at $1.15 billion (down 0.6%). A decline of 12% in revenues from CDs to $615 million offset a 19% increase to $504 million from vinyl records. This represents the largest revenues from vinyl since 1988 and 14 years in a row of growth for vinyl albums, but the category only represents 4.5% of total revenues.

To download the full report go here.