Streaming

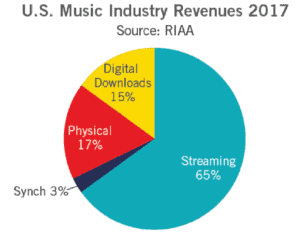

Streaming music platforms accounted for almost two thirds of total US music industry revenues in 2017 and contributed nearly all of the growth. The streaming category includes revenues from premium subscription services, streaming radio services including those revenues distributed by SoundExchange (like Pandora, SiriusXM, and other Internet radio) and ad-supported on-demand streaming services (such as YouTube, Vevo, and ad-supported Spotify).

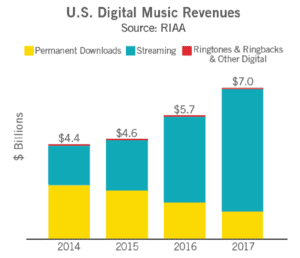

Paid subscriptions were the biggest growth driver for the music industry in 2017. Year on year revenue growth of 63% brought total subscription revenues to more than $4 bn for the first time, making it by far the biggest format of recorded music in the US comprising 47% of the total market.

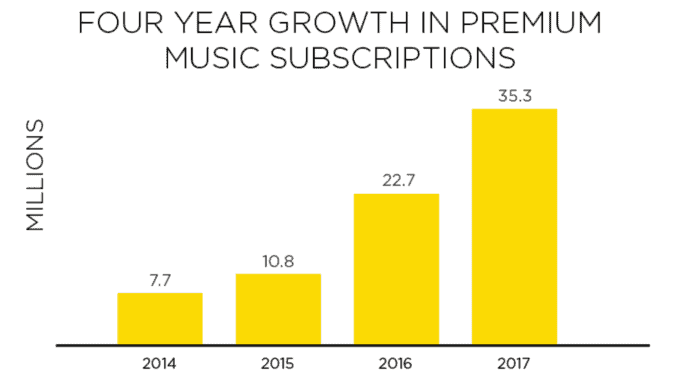

Subscription growth was driven by continued rapid user adoption as the number of paid subscriptions to full on-demand services grew 56% to average 35.3 million for the year compared with 22.7 million in 2016. New services like Pandora Premium, iHeartRadio All Access and the first full year of Amazon Unlimited added to a growing group of offerings along with established services like Apple Music, Spotify, Tidal, and others.

Downloads

Revenues from digital downloads fell 25% to $1.3 bn in 2017. For the first time since 2011 revenues from physical products exceeded those from digital downloads. Revenues from sales of track downloads were down 25% and digital album revenue decreased 24% compared to 2016.

The total value of digitally distributed formats in 2017 was $7.0 billion, up 22% from the prior year, and contributed 82% of total industry value.

Physical

Shipments of physical products decreased just 4% to $1.5 bn in 2017, a lower rate of decline than in recent years. Vinyl continues to be a bright spot among physical formats with revenues up 10% to $395 million. Shipments of CDs continued to decline, falling 6% in 2017 to $1.1 bn. Revenues from shipments of physical products made up just 17% of the industry total in 2017.