Global music streaming growth slows in Q2 2020 but grew 13% year on year with revenues of $6.7 Bn according to global research firm, Counterpoint Technology Market Research. This is the first-ever quarter on quarter decline in terms of revenues as music streaming has been gaining strength with every passing quarter. Paid subscriptions grew 29% year on year (YoY) compared to 35% YoY in Q1 2020.

Research Analyst Abhilash Kumar said, “The growth slowed down in Q2 and, for the first time, the revenues declined sequentially. There are a couple of reasons for the same. The music streaming platforms offered discounts and lowered prices for paid subscriptions to retain consumers or to prevent them shifting to a free plan. Also, advertisement revenues saw a dip since many companies cut expenditure in view of COVID-19. However, podcasts related to different genres were able to keep people glued, offsetting some of the decline.”

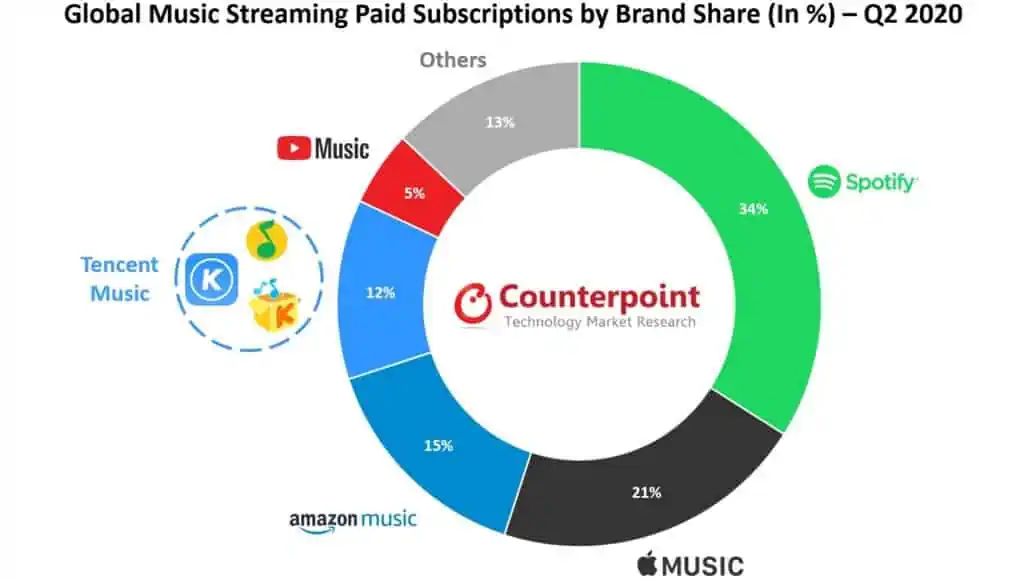

In terms of monthly active users (MAUs), Tencent Music (with its subsidiaries QQ Music, Kuwo and Kugou) led the chart in Q2 2020 with a 26% share, followed by Spotify and YouTube Music with 12% and 10% respectively. However, in terms of paid subscriptions, Spotify continued to lead with 34% share, followed by Apple Music (21%) and Amazon Music (15%).

Kumar added, “The social media platform and free availability of music help Tencent Music maintain the No. 1 spot in terms of MAUs. For similar reasons, YouTube Music is also among the top three. Strong brand presence, attractive offerings, continuous product improvisation and focus on podcasts have helped Spotify. Apple Music’s free six-month subscription offering in 52 countries helped maintain its share.”

The music streaming industry was almost immune to the ill-effects of COVID-19 in Q1. In fact, the streaming hours increased as people stayed at home. Starting Q2, the market witnessed a slowdown in growth, driven by sequential decline in both paid and ad-based revenues. Starting June-end, the growth is slowly coming back on track and Counterpoint analysts believe that growth will be back to pre-COVID-19 levels by Q4 2020.

Counterpoint’s in-depth ‘Global Online Music Streaming Market Tracker, Q2 2020’ can be found here.