Streaming grows to 85% of music revenue in US growing 5.6% to $5.7 Bn in the first half of 2020 according to the RIAA’s 2020 Mid-Year Music Industry Revenue Report. Streaming music grew to 85% of the market by value, compared with 80% the prior year. There were differences in trends between Q1 and Q2 of 2020, as retail store closures, tour cancellations, and other impacts of COVID-19 affected the music industry in many significant ways.

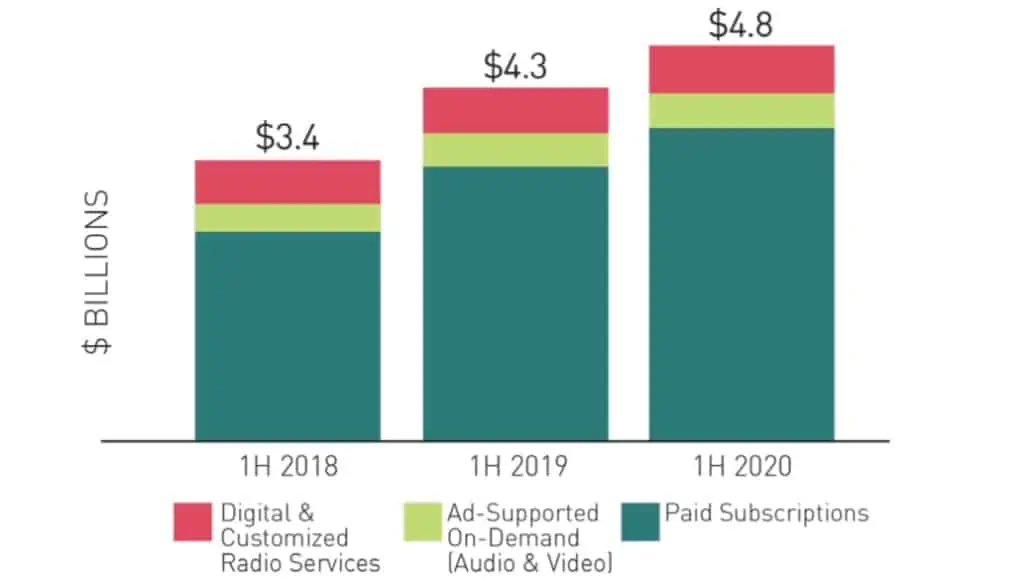

Streaming music revenues grew 12% to $4.8 Bn in the first half of 2020. This category includes revenues from subscription services (such as paid versions of Spotify, Apple Music, Amazon, and others), digital and customized radio services, including those revenues distributed by SoundExchange (like Pandora, SiriusXM, and other Internet radio), and ad-supported on-demand streaming services (such as YouTube, Vevo, and ad-supported Spotify).

Paid subscription revenues grew 14% to $3.8 Bn, and further increased their share as the largest contributor, accounting for 67% of total revenues for H1 2020. They also accounted for 79% of total streaming revenues. Paid subscription revenues grew faster in Q2 2020 than in Q1. This total includes $442 million in revenues from ‘Limited Tier’ paid subscriptions (for services limited by factors such as mobile access, catalogue availability, on-demand limitations, or device restrictions). Those types of services accounted for 12% of subscription revenues, a slight increase versus H1 2019.

The number of paid subscriptions continued to increase rapidly in H1 2020. The average number of subscriptions was 72 million, up 24% versus the first half average for 2019. That reflects the addition of more than 1 million net subscriptions per month on average.

Advertising supported on-demand streaming music revenues (from services like YouTube, Vevo, and the ad supported version of Spotify) grew 3% year-over-year to $421 million in H1 2020. This category was significantly impacted by broader advertising declines due to Covid-19 and accounted for just 7% of total revenues in H1 2020. Revenues from digital and customised radio services grew 6% year-over-year to $583 million in H1 2020.

Digital download’s share of the market continued to decline in H1 2020 with revenues falling from 8% to 6%. Revenues of $351 million were a 22% decline versus the first half of 2019. Individual track sales revenues were down 27% year on year and digital album revenues declined 18%.

Revenues from physical products of $376 million were down 23% year-over-year. There was a significant impact from music retail and venue shutdown measures around Covid-19, as Q1 2020 declines were significantly less than Q2 compared with their respective periods the year prior. Revenues from vinyl albums increased in Q1, but decreased in Q2, resulting in a net overall increase of 4% for H1 2020. Vinyl album revenues of $232 million were 62% of total physical revenues, marking the first time vinyl exceeded CDs for such a period since the 1980’s, though it still only accounted for 4% of total music recorded music revenues.

The full report can be downloaded here.