Podcast listening increases in Australia with 44% of respondents identifying themselves as podcast listeners according to a survey conducted by Deloitte and published in their Media Consumer Survey 2019. Despite the popularity the survey found that only 16% of podcast listeners have ever purchased an episode.

Focused on four generations and five distinct age groups, the 2019 edition of the Media Consumer Survey provides a view of how people in Australia are consuming media and entertainment, particularly digital media and entertainment. The survey found that Australian’s most preferred entertainment activities are:

52% Browsing the internet

51% Watching Free to air TV

37% Streaming video

36% Listening to music

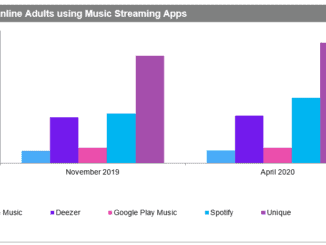

When listening to music only 21% of all age groups have a paid music subscription whereas 46% of younger listeners in the 30-35 age group are more willing to pay for streaming music services.

Podcast listening increases in Australia

Podcasts have steadily grown in Australia with 44% of respondents identifying themselves as podcast listeners, with Trailing and Leading Millennials* the highest users (59% and 57% respectively).

Alongside popularity in younger consumers, 67% of high income earners listen to podcasts. Those who engage tend to do so actively, where 47% of podcast listeners consume at least one episode each week, with 20% listening to three or more podcasts each week. It’s a format that relies heavily on word of mouth for discovery, with over half of listeners identifying friends and family, and social media in their top three ways to find new podcasts.

When it comes to genres, 36% of podcasters listen to news and current affair podcasts, making it the most popular, followed by comedy (28%). A quarter of listeners are tuning in to true crime – a genre synonymous with podcasting thanks to the success of podcasts such as Serial and The Teacher’s Pet. Across all age groups the strongest driver for listening to a particular podcast is to learn something new (39% of all listeners), particularly among Trailing Millennials (44%) and Xers (43%).

Despite the format’s on-the-go flexibility, most podcast consumers listen to podcasts at home (66%) as opposed to on the move, with 28% listening in the car and 15% on public transport. However, when it comes to paying for this content; only 16% of podcast listeners have ever purchased an episode although Trailing Millennials are more likely to do so (27%).

Payment is most commonly for individual episodes on websites (36%) rather than dedicated services (such as Apple and Google Podcasts – 31%). Subscription music services have emerged as a key platform for podcasts – almost a third of all listeners access them through Spotify and of those who paid for podcasts, 34% did so through their subscriptions to music streaming services.

How often do Australians listen to podcasts?

(Weekly usage)

Trailing Millennials 60%

Leading Millennials 57%

Xers 48%

Boomers 30%

Matures 20%

Smart speaker ownership increases

Smart speaker ownership continues to increase (12%), further fuelling our obsession with voice assistants. Google Home leads all contenders, accounting for 74% of smart speaker users. Penetration of smart speaker devices increases with income level, at 37% of high earners, younger generations using voice-enabled digital assistants such as Siri, Google Assistant and Alexa the most. 29% of Trailing Millennials use voice across any of their devices (phones, smart speakers, headphones) at least once per week, compared with only 16% across all other generations.

The survey reveals modest growth in smart speaker ownership with 12% of respondents now owning a voice enabled speaker up from 9% in 2018. Google continued its dominant market share with 74% of smart speaker owners choosing Google Home. 70% of consumers who have owned a smart speaker for more than six months report using the device as much or more than when they first purchased it. This suggests once a consumer finds a useful place for voice in their lives, it becomes a part of their regular routine.

Ownership of smart speakers increases with income level. This year, 37% of high income earners report owning at least one smart speaker. The use of voice-enabled digital assistants is highest in the younger demographic though, with 29% of Trailing Millennials reporting they use voice assistants on either their phone or smart speaker at least once per week.

How often do you use a voice-enabled digital assistant (Amazon Alexa, Siri, Google Assistant, etc.) on any device?

(Summary of daily and weekly user)

Trailing Millennials 29%

Leading Millennials 27%

Xers 20%

Boomers 22%

Matures 7%

*Trailing Millenials 14-29, Leading Millenials 30-35, Xers 36-52, Boomers 53-71, Matures 72+

The full report which also contains information on TV, video on demand, news and magazine content can be found here.