US music revenues grew for 7th consecutive year in 2022 up 6% to a record high of $15.9 Bn according to figures released by the RIAA. Streaming continued to be the biggest driver of growth with record levels of paid subscriptions, continued growth in ad-supported format revenues and growing contributions from new platforms and services.

Paid subscriptions continue to drive streaming growth

Streaming continued to account for a large majority of recorded music revenues in 2022. Paid subscriptions, ad-supported services, digital and customized radio, social media platforms, digital fitness apps and others grew 7% to a record high $13.3 Bn in revenue. They collectively accounted for 84% of total revenues, up slightly from 83% in 2021.

Revenues from paid subscription services grew 8% to $10.2 Bn in 2022, exceeding $10 Bn annually for the first time. They accounted for 77% of streaming revenues, and nearly two-thirds of total revenues. Limited tier subscriptions (services limited by factors such as mobile access, catalogue availability, product features, or device restrictions) grew 18% to $1.1 Bn. Services like Amazon Prime, Pandora Plus, music licenses for streaming fitness services, and other subscriptions are included in this category.

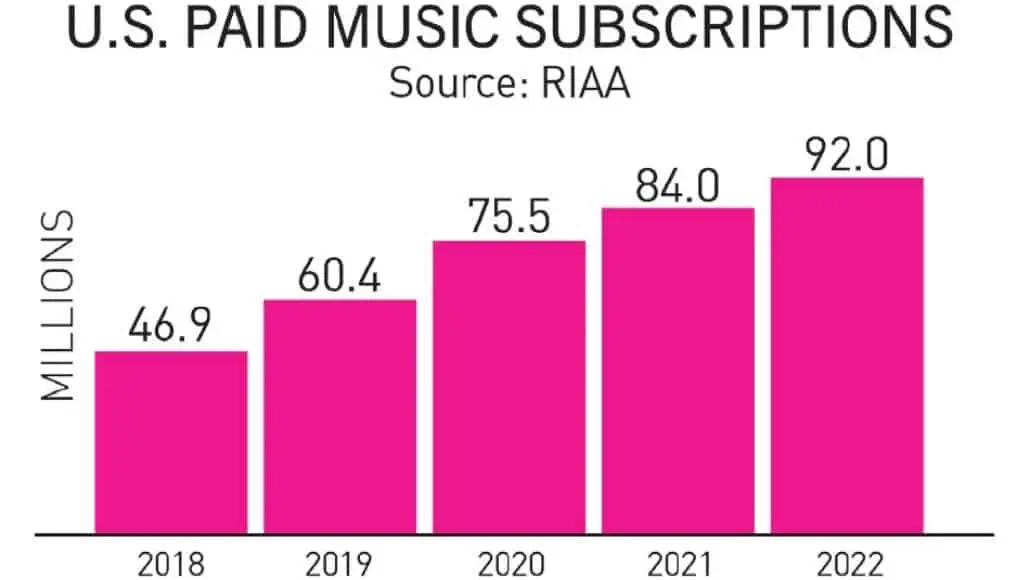

The number of paid subscriptions to on-demand music services continued to grow at double digit rates and reach new highs in 2022. The average number of subscriptions for the year grew 10% to 92 million, compared with an average of 84 million for 2021. These figures exclude limited-tier services, and count multi-user plans as a single subscription.

Music revenues from advertising supported on-demand services (such as YouTube, the ad-supported version of Spotify, Facebook, and others) grew at a slower pace than previous recent years, up 6% to $1.8 Bn. This builds on a rapid rebound in 2021 compared with COVID-19 impacted levels in 2020. Ad supported services contributed 11% of total 2022 recorded music revenues.

Digital and customized radio music revenues grew 2% to $1.2 Bn in 2022. The category includes SoundExchange distributions for revenues from services like SiriusXM and internet radio stations, as well as payments directly paid by similar services. SoundExchange distributions fell 3% to $959 million, while other ad-supported streaming revenues of $261 million were up 28%.

Digital Downloads

Revenues from digitally downloaded music continued to decline in 2022, down 20% to $495 million. Both digital album sales and individual track sales were down 20% to $242 and $214 million respectively. Downloads accounted for just 3% of US recorded music revenues in 2022, down from a peak of 43% of revenues in 2012.

Vinyl LPs continue to outsell CDs

Revenues from physical music formats continued to grow after their remarkable resurgence in 2021. Total physical revenues of $1.7 Bn were up 4% versus the prior year. Revenues from vinyl records grew 17% to $1.2 Bn – the sixteenth consecutive year of growth – and accounted for 71% of physical format revenues. For the first time since 1987, vinyl albums outsold CDs in units (41 million vs 33 million). After a 2021 rebound versus the COVID impacted 2020, revenues from CDs fell 18% to $483 million in 2022.

The full report can be downloaded here.