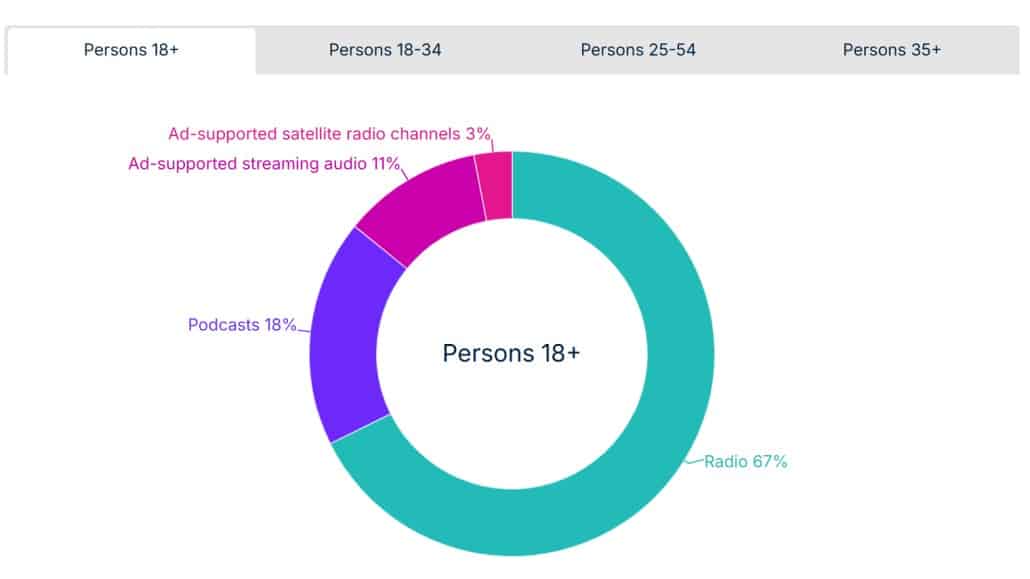

The latest edition of Nielsen’s The Record (Q3 2025) reveals that Americans spent an average of 3 hours 53 minutes per day listening to audio across all platforms — with ad-supported audio continuing to dominate overall listening. According to Nielsen, AM/FM radio remains the largest single component of audio consumption, while podcasts and ad-supported streaming services are expanding their reach among younger audiences.

Key findings from Q3 2025

- Ad-supported audio represented approximately 64% of total listening time, according to Nielsen’s The Record Q3 2025 report.

- Within the ad-supported audio universe:

- AM/FM radio (including digital streams) accounted for about 62% of listening time.

- Podcasts captured roughly 20%.

- Ad-supported streaming music services made up 15%.

- Satellite radio held around 3%.

- Listening habits vary by age group:

- Among 18–34s, radio’s share drops to around 43%, while podcasts rise to nearly 31%.

- Among 35+, radio dominates with a 69% share of ad-supported listening.

Broader context and trends

While radio remains dominant in the ad-supported audio landscape, streaming and digital formats are steadily gaining share. According to Edison Research’s Share of Ear (Q2 2025), streaming audio — including Spotify, YouTube Music and Pandora — rose by 5% year-on-year, while time spent listening to podcasts increased by 8%.

Nielsen reports that ad-supported streaming’s share of listening grew by 36% compared with the previous year, reflecting wider adoption of free, on-demand music platforms. Overall daily audio time stayed broadly stable, suggesting listeners are switching platforms rather than reducing total listening.

Implications for streaming services and consumers

The rise of ad-supported streaming creates opportunities for both advertisers and platforms. Services such as Spotify Free, YouTube Music and Pandora now compete directly with traditional broadcast radio for attention and ad revenue.

For consumers, this means more choice than ever. Younger listeners in particular combine radio for discovery, podcasts for depth, and streaming for convenience. Edison Research reports that almost 78% of US adults aged 18–34 listened to at least one podcast per month in 2025.

International perspective

Although Nielsen’s data covers the United States, similar shifts are evident elsewhere. In the UK, RAJAR’s Audio Time survey for Q3 2025 shows total audio listening steady at around 20 hours per week, with radio holding a 63% share. Ad-supported streaming and podcasts, however, continue to grow fastest among under-35s.

Summary

Nielsen’s The Record Q3 2025 confirms that audio remains central to everyday media habits. AM/FM radio still leads in overall listening, but the momentum behind podcasts and ad-supported streaming is unmistakable. Edison Research, RAJAR and other studies point to a generation shifting toward digital formats — an evolving but vibrant soundscape where the power of audio endures across every platform.