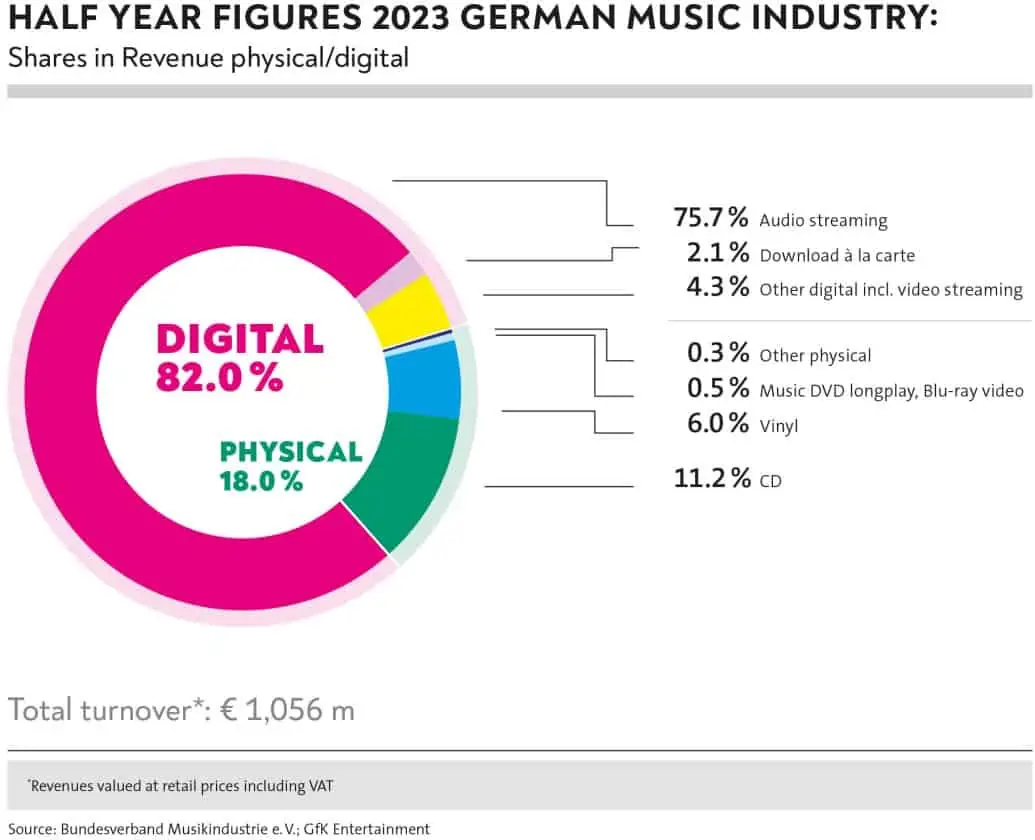

German music streaming sales grew 9.7% in first half of 2023 according to the BVMI, Germany’s recorded music industry association. Total sales were €1.056 Bn, an increase of 6.6% compared to the same period last year (H1 2022: €990 million according to the 2022 full-year accounts). Physical sales were at a similar level as in the same period of the previous year and thus remained stable (-0.8%). CDs continued to decline (-4.1%) but still contributed 11.2% to total sales, while vinyl came in at 6.0% of the market after another growth spurt of 6.3%. And contrary to the long-term trend, sales of DVDs/Blu-rays increased slightly (+0.9 %).

Together, CDs, vinyl, DVDs and physical singles currently still generate just under one-fifth (18.0 %) of sales, while the digital market, which gained 8.4%, accounts for a good four-fifths of the total. While revenues from audio streaming continued to grow by 9.7%, downloads declined by 4.9%.

Dr Florian Drücke, Chairman & CEO of the BVMI said, “Music sales in Germany continue to develop positively despite the economically complex overall situation. For many years now, streaming has been the well-known driver that has significantly increased the market as a whole, the famous pie, ultimately benefitting everyone involved, companies and artists alike. Unfortunately, this circumstance is ignored in the current unbalanced debate about the streaming market. Just as the entrepreneurial perspective is all too often left out, which in recent years has had to adapt again and again to changing market conditions and new players.”

Drücke continued, “Today, the way into the music market is literally open to everyone with a functioning internet access; artists are free to choose whether and if so, which partnership and services they want to use; accordingly, the co-operations between labels and artists are modular and highly individual in the case of a collaboration. At the same time, it is our member companies who pay the advances, which in the vast majority of cases are not being recouped. This high entrepreneurial risk is also part of dealing with our industry’s realities and the roles of the respective partners in the market.”