US music revenues grew for 8th consecutive year in 2023 up 8% to a record high of $17.1 Bn according to figures released by the RIAA. Streaming continued to be the biggest driver of growth with record levels of paid subscriptions, continued growth in ad-supported revenues and growing contributions from new platforms and services.

Paid subscriptions continue to drive streaming growth

Streaming continued to account for the great majority of recorded music revenues in 2023. Paid subscriptions, ad-supported services, digital and customized radio, social media platforms, digital fitness apps and others grew 8% to a record high $14.4 Bn in revenue. These services collectively accounted for 84% of total revenues for the second year in a row.

Revenues from paid subscriptions grew 9% to $11.2 Bn in 2023, accounting for 78% of streaming revenues, and nearly two-thirds of total revenues. Limited tier subscriptions (services limited by factors such as mobile access, catalogue availability, product features, or device restrictions) fell 4% to $1.0 Bn. Services like Amazon Prime, Pandora Plus, music licenses for streaming fitness services, and other subscriptions are included in this category.

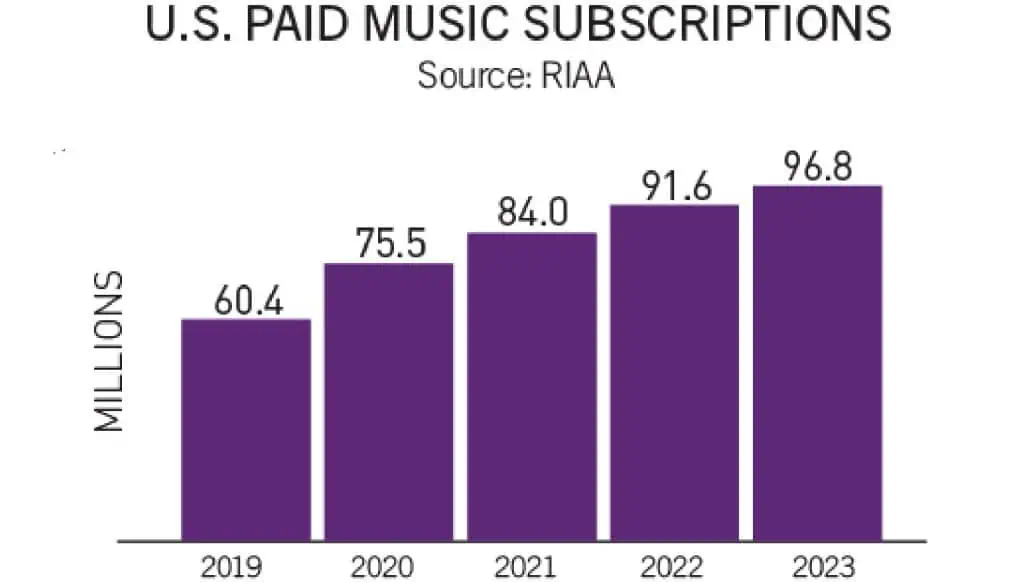

The number of paid subscriptions to on-demand music services continued to grow and reach new highs in 2023. The average number of subscriptions for the year grew 5.7% to 96.8 million, compared with an average of 91.6 million for 2022. These figures exclude limited-tier services, and count multi-user plans as a single subscription.

Music revenues from advertising supported on-demand services (such as YouTube, the ad-supported version of Spotify, Facebook, and others) grew at a slower pace than previous recent years, up 2% to $1.9 Bn. Ad supported services contributed 11% of total 2023 recorded music revenues. Digital and customized radio music revenues grew 8% to $1.3 Bn in 2023. The category includes SoundExchange distributions for revenues from services like SiriusXM and internet radio stations.

Digital Downloads

Revenues from digitally downloaded music continued to decline in 2023, down 12% to $434 million. Both digital album sales and individual track sales were down double digits to $205 and $191 million respectively. Downloads accounted for just 3% of US recorded music revenues in 2023, down from a peak of 43% of revenues in 2012.

Vinyl LPs continue to outsell CDs

Revenues from physical music formats continued to grow after their remarkable resurgence in 2021. Total physical revenues of $1.9 Bn were up 11% versus the prior year. Revenues from vinyl records grew 10% to $1.4 Bn – the seventeenth consecutive year of growth – and accounted for 71% of physical format revenues. For the second time since 1987, vinyl albums outsold CDs in units (43 million vs 37 million), even as revenues from CDs also show growth, up 11% to $537 million in 2023.

The full report can be downloaded here.